A Comprehensive Guide to Evaluating Real Estate Syndication Capital Calls As A Passive Investor

It finally happened; you have received the dreaded email from the sponsor letting you know that the deal in which you have invested your hard-earned money as a limited partner now requires additional capital calls to keep it afloat. It’s normal in this circumstance to feel taken advantage of, betrayed, and, in some ways, unprotected and exposed. It’s also not uncommon to feel unadulterated emotion when your stomach drops, knowing that the $25,000, $50,000, or more that you invested in this deal might now be at risk. This was supposed to be an investment that was supposed to make money and provide passive income on your path to financial independence. Your first thought might be to never invest in these types of alternative investments again, and that would not be an uncommon reaction. However, just like any of these unexpected events in life, it often makes sense to take a step back, take a few deep breaths, and think this through before emotionally reacting.

Just to clarify, there are “planned capital calls” and “unplanned capital calls”. Planned capital calls are when you elect to invest in a deal or a fund and your capital has not been called yet. This type of scenario is common in real estate investment funds or new development opportunities. Conversely, for the sake of this discussion, we will be talking more about the “unplanned capital calls” that often occur due to changes in deal dynamics and/or finances, and in the more common scenario, these deals that are experiencing distress.

Unplanned capital calls are something we, as passive investors, never want to be a part of and are often something that many passive investors are not familiar with. We have put together this conservative investor’s guide in an effort to guide both the mindset and the decision-making process as to what key variables to consider. The obvious typical disclaimer is that this is not investment or financial advice and coordinate with your own financial and tax advisors, who know your circumstances better than I do. We at Passiveadvantage.com produce content and education for limited partners, as well as develop tools to help guide investments so that you might be less likely to receive this kind of call. However, if this unfortunate circumstance occurs to you, this article gives you some of the considerations when you’re evaluating a deal and whether to contribute additional capital via a capital call.

To take a step back, real estate syndication investing offers passive investors a chance to participate in lucrative real estate deals without the responsibilities of active management. As a passive syndication investor, you invest a portion of the deal that will be applied to the equity component (as opposed to debt in this circumstance), and in exchange, you receive a return or a portion of the profit from the deal, often in the form of tax-advantaged income from that deal. This comes in the way most commonly as a preferred return, combined with a promotion or split where the sponsor and the limited partner split the remainder of the profit of the deal. The trade-off of this type of passive investment is that you have very minimal liquidity, In addition, as a limited partner, once you make your investment, you lose any control over the deal. Thus, all day-to-day operations and management are out of your hands. There are some benefits to this lack of control in that you don’t have to spend your time doing those things that are required to enact the business plan and execute a successful deal. In addition, you are not liable for any legal ramifications that might take place at the property or on the property itself. However, it’s important to understand the capital stack and how real estate investment funds utilize capital calls to maintain the investment.

From a return standpoint, the reason many passive investors consider incorporating these types of deals into an overall portfolio in many cases is in conjunction with typical equity/stock market investments. It offers many investors the benefits of additional compounding that we typically would not find in traditional stock market investing. Over time, for those investors who make multiple investments in syndications, one can more quickly scale their passive income and shorten their path to financial independence. In addition, due to some of those limitations, such as lack of control and limited liquidity, there is often a premium on the rate of return that one has the potential for in these deals compared with other options such as Treasury bonds and traditional equity or stock market investing. However, with that increased return premium also comes the cost of more risk. Although admittedly, over the last 5 to 10 years, that risk was easy to forget about as a passive investor, where it had been the norm to get great returns with early exits in many deals. However, now that risk premium that was always there has reared its head once again as it eventually does every cycle with many investors having deals they’re invested in, pausing distributions, or worst-case, requesting capital call requests or even loss of capital altogether.

A crucial aspect of this investment model that you hope to not have to learn about firsthand is a capital call, where investors are asked or required to contribute additional funds beyond their initial investment. Evaluating these capital calls is essential for passive investors to make informed decisions and maximize returns while managing risks effectively.

Capital Call: What is it? Why now?

A capital call is a request from the GP (General Partners/Syndicator) to the LPs (Limited Partners) for additional funds beyond their initial investment. These calls usually occur when the syndicated property requires additional capital for various reasons, such as unexpected repairs, renovations, or a change in debt structure or interest rate. These days, the most common reason why properties require a capital call is due to the rapid and aggressive increase in interest rates by the Federal Reserve in the short period over the last year or so. Many sponsors were using short-term bridge loans to enact their value-add plans, where they would take a short-term loan with a variable rate that would eventually reset. The plan was to renovate properties during the period that the low-rate loan was fixed and then sell or refinance before that loan rate expired. What was not accounted for was how rapidly and drastically the Federal Reserve decided to increase interest rates to combat inflation, and this left many sponsors in the lurch. Even if the loan was not coming due, many lenders require an escrow for any upcoming rate cap extensions, thus, as the cost of rate caps on these variable loans skyrocketed, this unexpected expense ate into the cash flow and operating reserves of a deal. The few deals that were cash flow positive would have been able to refinance, or those deals that already had fixed rate debt in place were in the catbird position. Unfortunately, a large number of those deals had the aforementioned interest rate cap, which keeps the amount that the rate can exceed the initial rate to a maximum percentage, often based on a fixed index such as SOFR. Many of those rate caps already have or are set to expire over the next 12 to 18 months in 2024 and 2025. Thus, to make it simplistic, the cost of debt for these properties far surpasses what the projection was initially, making many of these properties negative from a net operating income (NOI) standpoint. There are mandatory capital calls and optional capital calls, which are fairly self-explanatory. This is a situation as a limited partner where you need to dig into the private placement memorandum and be sure exactly what the dynamics and structure of how capital calls could be instituted by your sponsor.

Most Common Indications for an Unplanned Capital Call

Debt-Related Capital Call

By far the most common reasons we are seeing capital calls these days are because of the rapid and unprecedented increase in interest rates. Many of those sponsors who used short-term, or bridge debt, with a floating interest rate are now being required to creatively manage the increased debt expense. The appeal at the time for sponsors using a value-add plan in a real estate investment fund was that in many cases you could get up to 80% leverage on these deals, therefore requiring sponsors to raise only 20% equity. From a return perspective to LP’s and sponsors, the more leverage on a deal, the more opportunity for an outsized return. There is a give-and-take seesaw balance in many deals in that when kicking up the leverage, it improves the LP returns, but conversely, it also adds additional risk. Debt is by far one of the biggest controllable risk variables when underwriting a real estate deal, and this is why so many lenders require a particular threshold for a debt service coverage ratio (DSCR). As was stated, much of the risk in the current market is related to the fact that these loans in trouble were for short-term periods, typically three years with the ability to add on two one-year extension options. Often, in those additional extension years, the rate went to a variable component, which with the rapid rise in interest rate left many sponsors in the lurch.

This “variable rate” was common practice when things were going well over the last 3 to 5 years, and many sponsors that wanted to add on some risk mitigation strategy purchased what is called a rate cap. When times were good these rate caps were very affordable, however, in these new times, rate caps went up, in some cases 100 to 1000 times the cost of what they were when initially underwriting the deal. In some cases, even if a rate cap is not due as of yet, due to the increased cost of rate caps, many lending banks require an updated rate cap escrow, which significantly increases the cost of debt, which eats into property cash flow and ultimately NOI. For those deals looking to refinance into fixed-rate debt, there is often a DSCR requirement, which due to decreasing NOI may be tough to meet without injecting additional capital into the deal. It is estimated that at least 25% or more of the current multifamily deals that are coming up with a rate cap expiration will not qualify for the ability to refinance. This is a staggering number, and this is what led to much of the news headlines we hear about the upcoming crash in multifamily. For these deals that might be underwater or not meet the DSCR requirements to refinance, they would need to bring cash to the table to qualify for the refinance. This is called “cash-in refinance,” where the sponsor is attempting to refinance into a new more affordable fixed-rate loan, typically out of a variable rate or bridge loan, to stabilize the debt cost on the property. These cash-in refinances can have nuances that you need to be aware of. Some questions to consider are: Is the Refi term into a new fixed rate loan, or is it simply an extension where the new loan terms are only for one year as a “new bridge loan” per se? You need to ask if this money is simply being used to extend or to get a new rate cap, which typically would be for an extra year only to find ourselves in the same position a year from now. These two loan dynamics of a refinance have very different implications and prospects for a successful outcome for an LP. Thus, in essence, you need to know how much time this takes to close the deal, and that is a big factor in the potential ability of the sponsor to turn the deal around. For more detail, we have a debt article here that explains some of these nuances. Additionally, real estate investment funds can play a crucial role in providing capital for such refinancing endeavors, especially in scenarios where traditional lending falls short.

Unforeseen Expenses

Separate from debt issues in the current real estate market, another unexpected factor that has a large impact on the deal dynamics is inaccurately projecting expenses during initial underwriting or not accounting for unexpected costs. This can come in the way of insurance-related costs (in particular in FL and TX), as well as possibly new property tax reassessment projections. In some cases, the additional costs come in the form of increased cost of labor and materials to accomplish renovations and the value-add plan can also eat into the bottom line of the deal. Additionally, real estate investment funds often face challenges in managing their capital stack efficiently, especially when dealing with unforeseen capital calls necessitated by these unexpected expenses.

Cash-Flow Shortfall

For any of the reasons above, many deals could be falling short on operating cash flow, and this can be a huge red flag in some of these deals. Quite simply, the cash flow from the deal is the difference between net operating income versus the total expenses. This cash flow is what makes the project profitable and gives it a cushion during times of upheaval. Often, when we are evaluating a capital call, we will consider what the “Path to Cashflow” of this property and how realistic is it. This cash flow shortfall could be due to either increased expenses, decreased income, or both. Ultimately, either of these scenarios will affect the net operating income of a property and its bottom line. For example, although this is not common in the current real estate distress if there is a significant drop in occupancy it could affect the operating income of the property. Another example is whether there was a significant weather event with down units or a severe crime on the property that may affect the desirability of the property for its tenants. Ironically, in this day and age, occupancy is fairly high, and that hasn’t been one of the driving forces to the current real estate distress that we’re witnessing. These different types of property challenges require careful inspection by the LP when deciding as a limited partner whether to inject additional capital into a deal, as it is a common scenario of “good money after bad” and the need to be diligent as to the use of added capital and if it will have an impact. Real estate investment funds often grapple with the management of their capital stack amidst such scenarios, where unexpected capital calls may arise, adding further complexity to their decision-making process.

Key Factors to Evaluate Capital Calls

1. Look Within

The first step to many of these decisions, whether they be in life or investing, is to look within yourself as to what your expectations are and where you are at this juncture in your life. That is, you need to honestly assess where you are both mentally and financially as to whether you are in a position to take on this additional risk of a capital call. When evaluating a capital call, one must look at these deals through the lens of a brand-new investment decision, even though you have already made one at the start. Now the deal dynamics have changed, and you need to take a new look as to whether this deal still appeals to you and still seems like a profitable business plan. However, if you are at a point in your life or at this moment in time where you have minimal liquidity or are at a point where you don’t want to take on any additional risk, in that case, you may choose to pass on the contribution of additional capital. The liquidity component is key in that it’s not usually recommended to scramble together money or borrow money that you can’t afford to lose when investing in these types of capital calls. If you happen to have money sitting on the sidelines or money earmarked for real estate investing it might be a different consideration. Real estate investment funds often navigate such decisions meticulously, considering the implications on their capital stack and the overall strategy of the fund.

2. Sponsor Business plan “The Second Act” One-on-One with the Sponsor

Although you need to understand the business plan at the start of any syndication investment and whether it matches up with your goals and risk profiles, now it’s even more important when considering contributing extra capital in the form of a capital call. You need to get down to the nitty-gritty with a sponsor, and they should be willing and able to devote time to your questions and inquiries. I would go as far as to say it would be appropriate for you to ask for a personal phone call with a sponsor to discuss some of the questions you have. The first question should be: has the sponsor ever experienced a capital call? And if so, how did they navigate it in the past? You need to get into specific metrics, such as, What specifically will your new capital be used for? Whether it is a brand-new investment or deciding on the capital call the most important factor in any of these deals always comes down to the sponsor and the team. You then need to assess both how they respond to your questions and what the answer is about the usage of new capital to get a feel for their grasp on the utility and use of this additional money. If it does not appear that this money will save this deal, then you might be throwing good money after bad and it’s something you may want to pass on. Ask the sponsor to reaffirm to you the investment objectives and the business plan and how this additional capital will help, specifically in detail. Even more so than when you’re investing in a new deal, my feeling is that the onus is on the sponsor who needs to re-sell you on the deal now more than ever.

For example, if they plan to use this money to refinance the deal into a fixed-rate debt that, after being implemented, will then bring the property back to positive cash flow, that would be a reasonable thesis. If the money is needed for construction or labor costs to help renovate additional units to bring more units up to the market rent that was expected in a deal, once again, to make the deal cash flow positive that might be reasonable. Other considerations would be whether or not the factors that affected the capital call or within or outside of the sponsor’s control. In circumstances where the sponsor could have foreseen these possible difficulties at the deal’s outset, it may portend less confidence in that sponsor’s preparation and their underwriting criteria. Real estate investment funds often scrutinize such decisions carefully, weighing the implications on their capital stack and the overall performance of their portfolio.

Lastly, you should ask the sponsor directly what they are doing personally to help keep this deal afloat. In the same sense as when you’re looking at a deal from the start, you want to see “skin in the game” from the sponsor and that is an even more fair question at this stage as well. Is the sponsor coming out of their pocket with an additional financial commitment themselves, just like they’re asking you to keep this deal afloat, and if so, how much? While the deal is underperforming, are they pausing their asset management fees during this time? As an investor, you need to know what the sacrifices are that the sponsor is making to keep this deal afloat, and that gives you an idea of their commitment to the deal if they put their money where their mouth is. Is the sponsor offering some form of concession to investors for participating in the capital call? This may be in the form of an investor-friendly increased preferred return or a more favorable reduced split or promotion on the capital call money once the deal sells. The key takeaway is that a good sponsor should be willing to offer some type of olive branch to investors in acknowledgement of the situation and the investor taking on additional risk. Real estate investment funds, when faced with such challenges, often assess the impact on their capital stack and may negotiate with sponsors to ensure the best possible outcome for investors.

3. Sponsor Transparency and Communication

At Passiveadvantage.com, we emphasize the critical role of sponsor communication in evaluating a passive syndication opportunity. Not only does it keep investors informed about the property’s progress, but it also provides insight into how the sponsor values its limited partners. Assessing the GP’s communication practices is essential both before making an initial investment and particularly in the face of unexpected capital calls. Has the sponsor been transparent about the possibility of capital calls and the challenges at the property level, or did the capital call announcement come as a surprise?

Moving on to another crucial aspect, let’s delve into the concept of the capital stack within real estate investment funds. While somewhat nuanced, understanding human nature is key, especially in how it influences sponsor communication. Often, true sentiments are revealed more accurately through actions rather than words. When faced with adversity, individuals may exhibit tendencies to avoid confrontation. Observing the sponsor’s behavior leading up to the deal and during the capital call provides valuable insights into their true feelings and the potential for the deal’s success. Are they responsive and proactive, or do they become defensive and uncommunicative? These behavioral cues serve as indicators when considering additional capital contributions to a deal.

Sponsors with deals in trouble better be “over-communicating,” hosting webinars and Q&A sessions with LPs to explain the capital call and the plans for the additional funding. Once again, I fully admit that this is a nuanced perception, but in my experience, both with myself and helping other investors, this is often the case. In many of these deals’ sponsors will stop or pause distributions before asking for a capital call. You can get a preview or a hint as to how they will handle capital call preparation based on how they went about announcing to their limited partners that distributions were going to be paused or halted and what the communication was around that process leading up to the capital call. If the sponsor has been forthcoming and almost pre-warning as to what is to come but also open to how they’re going to turn the deal around, then I am much more confident in that sponsor and the use of my additional capital to contribute to the deal. Transparent communication is vital for keeping investors informed about the reasons behind the call and the expected outcomes. Look for regular updates on property performance, market conditions, and any changes in the investment strategy that might impact future capital calls.

4. Property Level and Limited Partner Financial Analysis

The next step is to analyze the capital call as a new and distinct investment because, in essence, that is exactly what it is. In the big picture, as a limited partner, you need to ask yourself what the “path to cash flow” of this property is. To do that, it comes down to a basic calculation between the expenses and the income and how that will ultimately affect the net operating income (NOI) at the property level. Just like you would in an initial investment, you need to ask the sponsor how the injection of this cash will impact the break-even occupancy of the deal. Break-even occupancy (BEO), is an important metric to understand as to how much room or headway the deal has and to where I could still be successful. You need to know what that BEO number is now versus what it will be after the capital injection, and how this new capital will help that number in the future.

You need to understand the trend line for the revenue of the property which typically comes in the form of either higher market rent rates or higher occupancy. What is the current rent rate of the property compared with nearby properties, and what are the averages for that geographic area? This is information that can readily be found online concerning rent rates in that area, and you can compare that with what the sponsor is projecting the new rates to be. In many cases, in this current real estate market, occupancy has not suffered, and many properties are already at high 90% occupancy rates; therefore, that lever cannot be pulled. Thus, in many cases, you need to either increase your rent rate typically in the form of value-added improvements, or decrease expenses, which often come in the form of a decreased cost of debt, but could also be insurance, taxes, etc. It’s important to understand how these levers and pushing and pulling them can affect the ultimate income of the property, which is the deciding factor as to whether or not the property stays afloat.

Separately, you need to crunch the numbers to be sure that the new plan that the additional capital will be used for makes financial sense. This needs to be evaluated on a deal-by-deal basis since many different options might lead to distress, which would require a capital call. Piggybacking on a prior point, the sponsor needs to be crystal clear as to how this new capital will impact the deal and turn around the reason for its current difficulty or shortfall. This discussion should not be overly complicated, and if the sponsor cannot outline the investment plan, that serves as a red flag. A key thing to discuss with the sponsor is to compare the original business plan to the actual performance and then determine why the underwriting at the start fell short. What was the miscalculation that led to the performance falling off track? What is the distress point that the deal encountered? Is this something that the sponsor could have predicted and may have miscalculated when initially underwriting the deal? This discussion with the sponsor is key when assigning culpability as to what the distress point was in the deal.

5. Exit Strategy

To get an idea of the forward-thinking nature of the sponsor and how detailed they are in the analysis and reasoning behind the capital call, you need to be informed of this new exit strategy. Ask the sponsor what the goal of the capital call is and how this leads to a plausible exit strategy. For example, is the capital to refinance the deal and stabilize the debt to eventually sell, or is it simply to create reserves since the property is in a position of negative cash flow?

In the case of a refinance being the goal of the injection of additional capital, many of these refinances will be parlayed into a fixed-rate loan, which is typically an agency loan that includes Fannie Mae and Freddie Mac. Many of these agency loans need a debt service coverage ratio (DSCR) of at least 1.25 or more. This means that there needs to be a 25% cushion in the net operating income versus what the cost to maintain the property is. In addition, agency lenders also like to see new LTV loan-to-value in the range of 60–65% right now, which can make it very difficult to qualify for a refinance without a significant cash injection into the deal. These two example scenarios are very different in the desirability of whether a limited partner should contribute additional capital to the deal. Thus, from the big picture standpoint, a limited partner in general can get an idea of the risk assessment or the likelihood that the deal will be able to be turned around and ultimately exit successfully based on the higher the debt service coverage ratio and the lower the LTV, which both would give the sponsor a better chance of finding refinance options. Lastly, you need to ask the sponsor what happens in the event the capital call is not funded or a refinance is not achieved. How would that impact this new exit strategy?

6. Risk Assessment

As a limited partner, you need to evaluate the risks associated with the capital call, such as liquidity risk and the possibility of a need for future calls. When assessing financial risk, one must compare it with what the alternative is in the current market. In this current market environment with Treasury bills and money market accounts offering a 4.5 to 5% rate of return, one needs to compare what the additional capital contribution would offer versus this base “safe” return and what the delta is to what the new return opportunities might be. Just as discussed above, you need to have a candid conversation with the sponsor about what the potential is for future capital calls to get an assessment as to what the likelihood is that more money will be asked for from a financial commitment standpoint. From a big-picture perspective, you want to consider the impact of possible future recessions or economic downturns, market fluctuations, or unforeseen events on the property’s performance and the syndication’s ability to meet its financial obligations.

7. Market Assessment

Just as you should have a thorough evaluation of the market when deciding on an initial investment, you should now reassess these market dynamics when evaluating a property and the capital call opportunity. If it has been some time since the initial investment was made, you need to re-calibrate as to whether this market still offers opportunity from an investment standpoint and if the favorable market thesis still exists. There are several metrics we preach when evaluating a market here at Passiveadvantage.com, and some of those include population growth, job growth, average income versus rent cost, the ratio of buying a home to renting a home, and overall, just general inward migration to the area, and whether or not this market still offers metrics in those dynamics that make sense. Is this market still growing and on the path to progress, or has it fizzled out?

8. Analyze the Existing Capital Stack and How it May Change

Another key variable we scrutinize at passiveadvantage.com is analyzing the capital stack in detail from the start when evaluating a syndication opportunity, but this becomes even more important when deciding as a limited partner to contribute additional capital to a deal. The capital stack refers to the layers of capital that go into purchasing and operating a commercial real estate investment. It outlines who will receive the income and profits generated by the property and in what order. This could include senior debt, mezzanine debt, preferred equity, common equity, etc.

Source: Crowdstreet.com

Is the capital stack extra complicated with multiple levels of debt and equity before the common equity/LP shares? Some of these added layers also include different class structures or tiers of LP equity within the deal, such as Class A shares, Class B shares, etc. Is there preferred equity or preferred debt in the deal? Is there Mezzanine debt? Without getting too much into the weeds, if there is mezzanine debt or pref debt within the deal, in essence, that adds on to the loan value, thus getting a loan of 70% LTV and 10% pref equity is technically an overall 80% LTV increasing the risk of the deal.

There are even subcategories of preferred equity or debt in how they are structured, for example, where it is either “hard pay debt” or “soft pay debt”. Another example is if the Pref equity partner is not getting paid the agreed-upon amount, say 6 to 8% monthly, they can then have the rights if it’s a hard pay structure, to fire the manager or the sponsor and take over the deal. In many cases, that might mean that this Pref equity partner can force the sale of the property prematurely, which could potentially wipe out limited partners’ capital if the profit on the deal is thin.

Therefore, in deals that contain pref equity or mezzanine debt, you want to be sure to understand the dynamics of how much control they have over the deal. You need to understand exactly where your investment sits in the capital stack, In that sense, often, as a limited partner, your “common equity” sits in the lowest or last priority position on the capital stack. Thus, the number of layers or components of the capital stack ahead of the common equity has a direct effect on your likelihood of receiving the projected return. In the scenario where a deal is spread thin to remain profitable, the more profitable the deal needs to be for you as a limited partner to get a fair return. In addition, aside from just the number of categories ahead of the limited partner in the capital stack, one must also look at the specific percentages of each of those categories as well. Obviously, the larger the percentage of ownership that precedes the common equity share, the higher up (less priority) you have as cash flow is distributed.

Lastly, you need to understand, based on the new sources of the capital call, how the capital stack will or won’t change post-capital call money injection into the deal. In many cases, the existing limited partner equity in the deal may become subordinate to a new member loan or fresh capital being contributed via preferred equity or mezzanine debt, as these new funding sources are typically compensated more favorably for taking on the additional risk than there was at the start of the deal. These concepts are often referred to as what it would take to “clear the capital stack”, which in essence means going through the order of preference of partners before it gets the limited partner or common equity.

Separately, if investors choose not to invest in a capital call, then they may experience what’s called dilution. Understand that if the dilution outlined in the operating agreement is a 1:1 dilution, LP equity is recalculated via the new ratio considering the additional capital. In some deals, the dilution may not be 1:1, and you may have a greater penalty if you do not participate in the capital call. You need to look at the nuances of this dilution component of the capital call and how that might affect your choice not to invest. This concept of limited partner dilution is discussed more in the next section.

9. Limited Partner Dilution: Legal and Regulatory Considerations

We at Passiveadvantage.com preach a thorough and detailed evaluation of all real estate operating agreements, or PPM, before investing in a deal. We have tools and education materials to help with that if you want to learn more, but generally, there are certain key components that we look at, one of them being a section called “capital call provisions”.

One needs to pay close attention to the capital call provisions within a private placement memorandum or operating agreement. In some cases, these provisions may limit the amount of capital call that can be asked for from a limited partner, say 5% of the initial investment, for example. Often, if a limited partner does not choose to invest additional capital, some dilution provisions would occur, and the typical percentage of ownership in a deal for that investor might then become less for anyone who chooses not to add the additional capital that has been requested by the sponsor.

Another similar but different scenario would be that if a limited partner chooses not to invest, there is a loss of equity. It should be noted that “loss of equity” is different from being diluted, where with dilution the investor’s stake remains the same but it is a smaller proportionate share. For those choosing not to invest, another possible outcome would be called “loss of distributions”, whereas for those limited partners that choose to not comply with the capital call, they would then lose all or some of their future distributions.

If the financial requirement cannot be met by the limited partner’s injection of capital, then the sponsor may search out additional money in the form of a loan that must be repaid. This loan can come from an outside bank or lender, or it may come from the sponsor or the partnership team itself. In many cases, these loans may have high interest rates, and any distributions that the partner is eligible for are instead used to pay down the balance of the loan first. This additional capital in the form of a loan or equity, resizes the ownership pie or structure of the original aka. Dilution. Conversely, a member loan does not dilute ownership but rather inserts a new form of capital that is subordinate to the senior loan but has priority over the common equity. In other words, member loans can “skip in line” in front of equity in terms of repayment priority where the partnership swaps equity for debt until the debt is repaid. Alternatively, if a significant gap in funding remains, then sponsors will typically seek capital from outside third-party providers (i.e., preferred equity or rescue capital). You need to understand the specifics within the ppm as to how these details are handled from a dilution standpoint to those limited partners. Understanding the capital stack and how real estate investment funds are utilized in these scenarios is crucial for making informed decisions as a limited partner.

Example Capital Call Dilution

“If all failed capital contributions are not funded by contributing members, the manager shall be permitted to fund such remaining failed capital contributions by obtaining a loan to the company or its subsidiaries or by raising additional equity in the company.” On the day following the Funding Due Date, the Percentage Interests of the Members shall be adjusted in the following manner: each Member’s Percentage Interest shall be the percentile equivalent of a fraction the numerator of which shall be the total amount of capital contributions made by such Member through and including the Funding Due Date (including any portions of any failed capital contributions funded by such Member) and the denominator of which shall be the total amount of capital contributions made by all of the Members through and including the Funding Due Date (including any portions of any failed capital contributions funded by the Members).”

In this case, the total capital invested and the amount you invested are reassessed to determine where the investor gets a new percentage of ownership. This is a fairly standard dilution language and a simple calculation. If the percentage of capital called as a component of equity already funded into the deal is small, your dilution won’t be material. However, if it is a significant capital call that is close to the original equity, then that equation changes significantly. Although this is a somewhat common verbiage for a capital call, there are certain other capital call agreements or verbiage that are much more punitive, so you need to carefully review this and may find it appropriate to obtain legal representation to help.

To further this point, investors who do not provide additional capital may find their ownership share of the limited partnership diluted. This can happen in two common ways:

1. Standard Dilution

To understand a standard dilution, consider a hypothetical example where you, as a limited partner, have invested $50,000 in a deal. The sponsor’s capital call requests 20% of the original equity or $10,000 for your share. If you decide not to contribute this amount, your equity share will be diluted by 17%.

$50,000/$60,000 = 83% (or 17% dilution)

Essentially, if you do not contribute to the capital call and other investors choose to contribute, you now own the same dollar amount of a new larger pie, which, by default, means you own a smaller percentage.

2. Punitive Dilution

In some cases, non-contributing investors can be further penalized by the sponsor through additional or what’s called a “punitive” dilution, over and above standard dilution.

Consider the same example as above, but now use a 1.5-times punitive dilution provision. For non-contributing members, the punitive dilution is then calculated in two steps. First, the amount called is multiplied by 1.5 ($10,000 x 1.5 = $15,000). The difference ($15,000 minus $10,000 = $5,000) is then deducted from the original equity contribution of $50,000 to determine the punitive dilution percentage.

$45,000/$60,000 = 75% (or 25% dilution)

If you decide not to contribute in this scenario, your equity share would be diluted by 25%, as compared to 17% in the simple dilution scenario. That difference (8%) is allocated to the investor(s) who contribute(s) on behalf of the non-contributing member.

Using Additional Funds via Capital Call as a Loan

To expand on a prior scenario, in certain cases, instead of the capital call contribution affecting the equity ownership in the deal and possibly diluting those who choose not to invest, there are other ways that this additional capital contribution can be handled. One of those scenarios is when a sponsor opts for what’s often called a “loan remedy,” whereby they convert up to all of the capital into a loan. The details, including repayment and interest on any potential loans, are laid out in the operating agreement.

As is typically the case with debt, a member loan would be paid off (with interest) first before any potential proceeds are paid to equity holders. These loans sometimes come with an option for contributing investors (or for the sponsor) to fund on behalf of non-contributing investors, providing those who participate an opportunity to “step in” and take on more than their current pro rata share of this loan.

Why would a sponsor choose to convert the requested capital into a loan? Often, this option can potentially provide a fast and simple solution for a sponsor to fund the capital call. Additionally, instead of punitively diluting non-contributing investors, a loan remedy can provide a viable solution to meet short-term capital needs, such as funding a closing on a refinance. Ultimately, since this loan would have to be paid back first before any distributions, it still penalizes those original equity holders; however, the penalty would be equal and less tangible.

Loss of Capital – Tax Implications

Typical disclaimer: although I am not a CPA or accountant, it goes without saying you need to discuss the discussion with your tax professionals. However, I will speak in general terms, although everyone’s situation is different. Say all the above discussions go wrong and ultimately you lose all of your originally invested capital on a deal. What can you do to try to make the best of that bad situation? When investing in a typical syndication, it is common to receive passive losses by way of bonus depreciation throughout the time of the deal. For most people, these passive losses can only offset passive income within a syndication or across several syndications. This is typically referred to as passive loss limitation in defining what can be offset by passive losses. In the event of a complete loss of capital at the time of a deal dissolution, there can be nuances that change that limitation. In certain circumstances, these losses can then be used to offset W-2 income even if you are not a real estate professional and even if you are not active in the deal. However, there are certain circumstances where you may even receive a penalty or be required to pay in situations where you receive bonus depreciation on a deal, some or all of it may be required to be paid back at the time of the dissolution. Once again, this is extremely nuanced and personal, and something to reach out to your CPA about if you were in the unfortunate circumstance that something like this occurred with your investment.

Conclusion

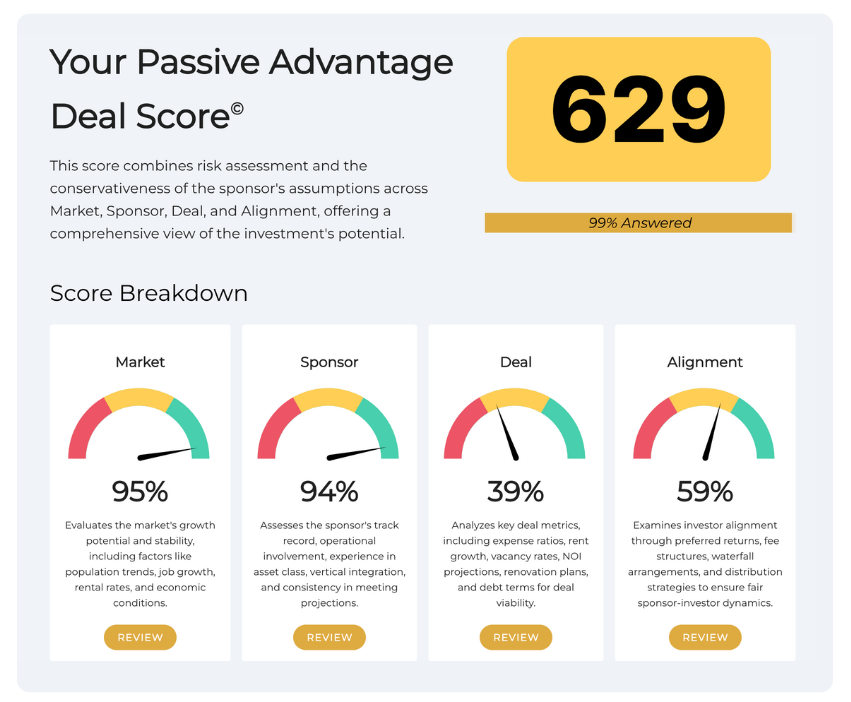

Now more than ever, it is critically important for limited partners to be fully aware of the many factors and dynamics that go into evaluating an unplanned capital call. As outlined above, it requires a thorough analysis of project performance, the purpose behind the call, the sponsor’s communication strategy and exit plan, and ultimately the likelihood of achieving a positive outcome. Tools such as our LP Deal Analyzer are designed to point out deal weak points or risks in a particular deal before investing. However, many of the same metrics we emphasize are still in play when deciding whether to add additional capital to a given deal in the event of that unwanted email asking for a capital call. Our ultimate hope is that this article, along with the many resources we offer at Passiveadvantage.com, gives limited partners the ability to prepare when considering these real estate syndication investments in the unfortunate scenario where we are required to contribute additional capital. After conducting your due diligence and considering all relevant factors, make an informed decision about whether to participate in the capital call. Remember that your decision should align with your investment objectives, risk tolerance, and overall financial strategy. Lastly, we always recommend seeking advice from financial advisors or legal professionals to help.

Disclaimer

Now more than ever, it is critically important for limited partners to be fully aware of the many factors and dynamics that go into evaluating an unplanned capital call. As outlined above, it requires a thorough analysis of project performance, the purpose behind the call, the sponsor’s communication strategy and exit plan, and ultimately the likelihood of achieving a positive outcome. Tools such as our LP Deal Analyzer are designed to point out deal weak points or risks in a particular deal before investing. However, many of the same metrics we emphasize are still in play when deciding whether to add additional capital to a given deal in the event of that unwanted email asking for a capital call. Our ultimate hope is that this article, along with the many resources we offer at Passiveadvantage.com, gives limited partners the ability to prepare when considering these real estate syndication investments in the unfortunate scenario where we are required to contribute additional capital. After conducting your due diligence and considering all relevant factors, make an informed decision about whether to participate in the capital call. Remember that your decision should align with your investment objectives, risk tolerance, and overall financial strategy. Lastly, we always recommend seeking advice from financial advisors or legal professionals to help.

If you're looking to invest passively in real estate syndications and have been evaluating opportunities from sponsors, go ahead and try out our AI-powered LP Deal Analyzer tool. New registered users received two free deals!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.