Roles of General Partners (GPs) and Limited Partners (LPs)

Real estate syndication provides an excellent opportunity for investors to participate in lucrative property deals without managing them directly. Within these syndications, investors take on different roles, primarily as General Partners (GPs) or Limited Partners (LPs). Understanding these roles is crucial to making informed investment decisions and ensuring smooth collaboration.

Understanding Real Estate Syndication

Real estate syndication is a structure where multiple investors pool their capital to acquire and manage properties that would otherwise be challenging to purchase individually. This setup allows passive investors to gain exposure to large-scale real estate opportunities without handling the complexities of property management.

In this setup, General Partners (GPs) and Limited Partners (LPs) have distinct roles and responsibilities that influence how a deal is structured and operated.

Who Are General Partners (GPs)?

General Partners, also known as sponsors, are the active members of a real estate syndication. They are responsible for the acquisition, management, and overall success of the investment. Their key responsibilities include:

1. Deal Sourcing and Acquisition

GPs identify and evaluate investment opportunities, conducting extensive research and due diligence before selecting a property. They assess factors like market trends, property value, and long-term potential to ensure the deal aligns with investor goals.

2. Structuring the Investment

Once a suitable property is identified, the GP structures the investment, determining aspects such as financing, legal entity formation, and investor participation. This includes defining ownership percentages, distribution schedules, and profit-sharing models.

3. Securing Financing

GPs arrange the necessary funding to acquire the property. This may involve securing bank loans, negotiating terms with lenders, and raising capital from LPs. Their ability to secure favorable financing terms significantly impacts the deal's profitability.

4. Asset and Property Management

After acquisition, the GP oversees day-to-day operations, ensuring the property performs according to the business plan. This includes hiring property managers, coordinating renovations, setting rental rates, and handling tenant relations.

5. Investor Relations and Reporting

GPs maintain open communication with LPs by providing regular updates, financial reports, and progress summaries. Transparency in reporting helps build trust and ensures investors stay informed about their investment's performance.

6. Executing the Exit Strategy

The GP determines the appropriate time and method to exit the investment, whether through a property sale, refinancing, or another strategy. The goal is to maximize returns for all stakeholders while ensuring a smooth transition.

Who Are Limited Partners (LPs)?

Limited Partners are passive investors who provide the capital needed for a real estate syndication but do not take part in daily operations. Their primary role is to fund the project and receive returns in accordance with the syndication agreement. LPs benefit from real estate ownership without the active management burden.

1. Providing Capital Investment

LPs contribute the majority of the investment capital in a real estate syndication. In return, they receive equity ownership in the property and a share of the profits based on their investment percentage.

2. Conducting Due Diligence

Although LPs are passive investors, they must conduct due diligence before committing capital. This involves evaluating the GP’s track record, reviewing financial projections, and understanding the deal structure to mitigate risks.

3. Reviewing Legal Agreements

LPs enter into a syndication agreement that outlines the terms of their investment, including ownership rights, profit distribution, and risk exposure. Carefully reviewing this agreement ensures they fully understand their role and expected returns.

4. Receiving Distributions and Returns

LPs earn returns through periodic cash flow distributions from rental income and profits from property appreciation upon exit. The distribution structure is typically based on a preferred return model, where LPs receive a priority percentage of profits before GPs share in the earnings.

5. Limited Liability and Risk Exposure

Unlike GPs, LPs have limited liability, meaning their financial risk is restricted to their initial investment. They are not personally liable for any debts, lawsuits, or management issues related to the property.

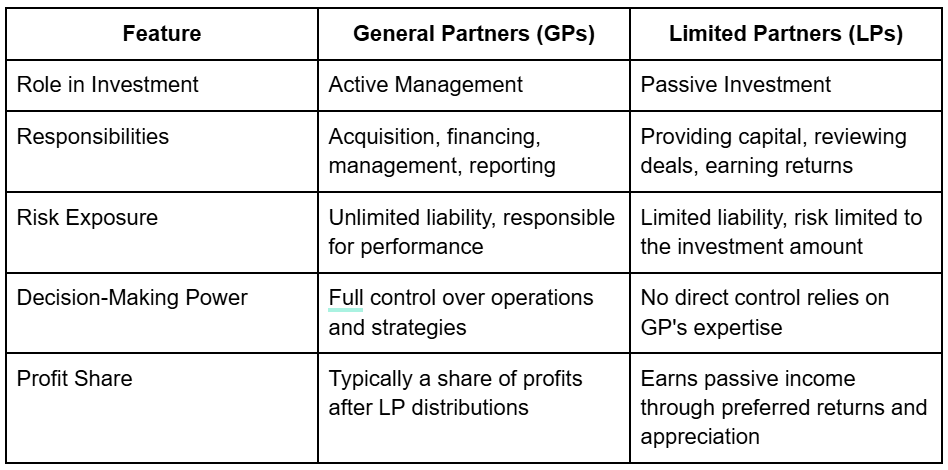

Key Differences Between GPs and LPs

While both GPs and LPs play crucial roles in a real estate syndication, their responsibilities, financial exposure, and level of involvement differ significantly:

The GP-LP Relationship: A Symbiotic Partnership

Successful real estate syndications rely on a strong partnership between GPs and LPs. GPs bring expertise, industry knowledge, and management skills, while LPs provide the necessary capital to fund the deals. This symbiotic relationship allows both parties to benefit from lucrative real estate investments while mitigating risks through shared responsibilities.

For passive investors, choosing the right GP is crucial. Conducting thorough due diligence in real estate, evaluating past deal performance, and ensuring transparency in communication can help LPs select trustworthy GPs to work with.

Understanding the roles of General Partners (GPs) and Limited Partners (LPs) is essential for anyone looking to invest in real estate syndications. GPs drive the deal by sourcing, financing, and managing the property, while LPs provide the capital and passively earn returns.

If you're considering investing in a real estate syndication as an LP, it's important to partner with a reliable sponsor who has a strong track record and a clear investment strategy. Passive Advantage offers tools and resources to help investors analyze syndication deals, vet sponsors, and make informed investment decisions. Try our real estate deal analyzer to learn more and start your journey toward passive real estate wealth today!

If you're looking to invest passively in real estate syndications and have been evaluating opportunities from sponsors, go ahead and try out our AI-powered LP Deal Analyzer tool. New registered users received two free deals!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.